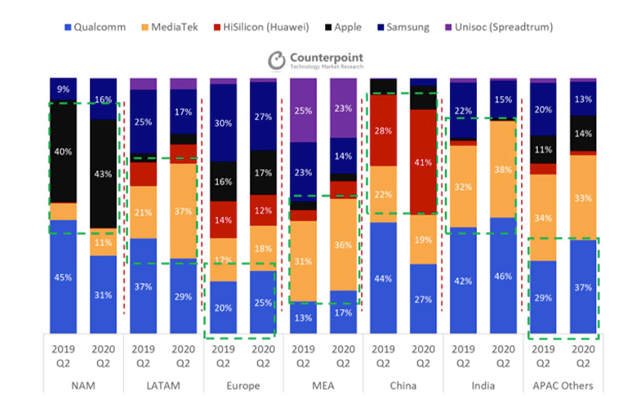

According to the report, Qualcomm lost 4% share year over year, closing at 29% in Q2 2020 as compared to 23% in Q2 2019. On the other hand, MediaTek saw its market share increase year over year. The company has a market share of 26% in Q2 2020 as compared to 24% in Q2 2019, closing in on Qualcomm’s lead. Qualcomm’s loss of market share was primarily due to US restrictions on Huawei. Post these restrictions, Huawei started using HiSilicon chips in its smartphones. With Huawei’s market share in China growing, Qualcomm’s chip shipments took a significant hit in the world’s largest smartphone market. “Qualcomm’s share in Huawei (including HONOR) smartphones declined from 12% in Q2 2019 to 3% in Q2 2020,” said Neil Shah, VP of research at Counterpoint Research. However, Shah also added that “5G smartphone sales more than doubled (+126%) in Q2 2020 from just a quarter ago. This trend will try to offset the overall decline in the first half and fuel the growth back in 2021. This will also create significant opportunities for AP suppliers to increase the share of semiconductor content even if the overall market volumes remain lower this year. Furthermore, the restrictions on Huawei will drive the growth for Qualcomm, MediaTek and Unisoc.” The report also shows the year over year change in market share by region. As you can see from the chart below, MediaTek has made significant gains across the world, with Qualcomm losing market share in North America, Latin America, and China. MediaTek, on the other hand, saw growth in North America, Latin America, Europe, Middle East, and India. Rounding off the top six are HiSilicon with 16% market share, Apple and Samsung with 13% market share each, and Unisoc with 4% market share in Q2 2020. Featured image courtesy: Counterpoint Research